Critical Minerals: The Next Supply Chain Battleground

Eclipse

|Feb 14, 2023

|5 MIN

In the latest installment of our “Innovate Our Way Out” series, Eclipse Venture Equity (VE) is sharing our internal research on the problems we think exist across mineral discovery, processing, synthetic production, and recycling.

By: Ryan Gibson and Diana Zhou

The Problem

Over the last several decades, we’ve witnessed every industry accelerate their digital transformation. While this evolution has brought tremendous productivity across sectors, it has also created massive reliance on the discovery, extraction, processing, and use of ‘critical’ minerals that comprise the compute and energy infrastructure powering our economy and are essential to the development of electric vehicles, solar panels, wind turbines, among other things.1 Figure 1 below shows the acuteness of this demand gap across various different critical minerals, especially as economies transition to low-carbon technologies.

Figure 1. Demand and Production for 22 Critical Minerals

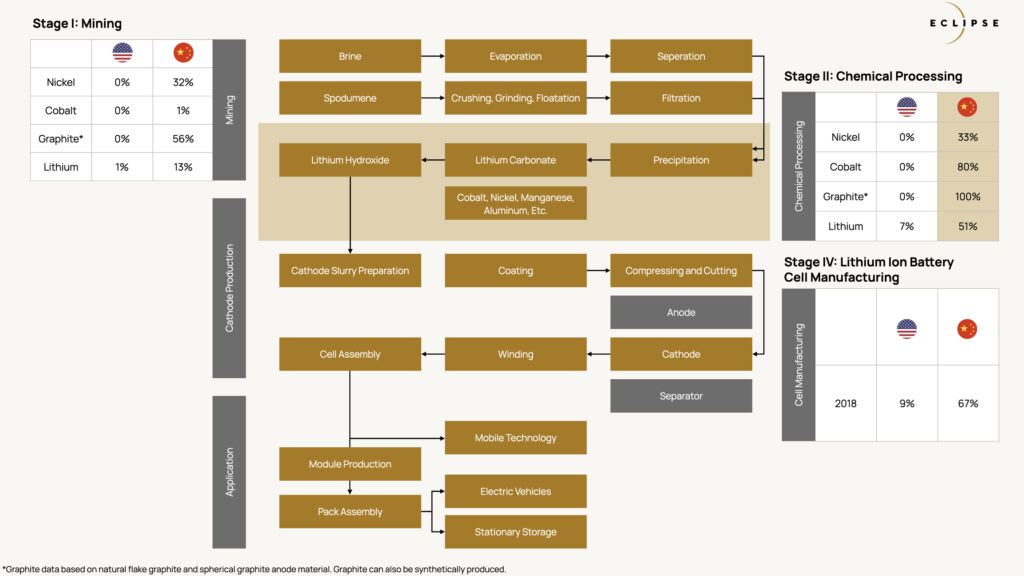

Critical minerals, such as copper, lithium, nickel, cobalt, and rare earth elements are essential to advancements in just about every facet of our economy, but sourcing these minerals is a concern in light of today’s de-globalizing economy. Today, the United States is 100% dependent on imports for 21 critical mineral commodities and is at least 50% dependent on imports for another 28 critical mineral commodities. China processes almost 90% of the world’s rare earth minerals (essential for all computing) and the majority of global lithium, graphite, and cobalt production (necessary for energy storage from medical devices and smart phones to electric vehicles and utility-scale renewables).

Figure 2. China Dominates the Downstream EV Battery Supply Chain

The Opportunity

We think many generational technology businesses will be built in this space in order to address fundamental bottlenecks across the discovery, production, and processing of critical minerals. Further opportunities also exist downstream, including the engineering and manufacturing of key technologies, such as renewable generation, batteries, semiconductors, and electrified transport. Although out of scope for this blog, these downstream supply chains need serious work and are full of massive opportunities.

Figure 3. The Opportunity in Critical Minerals Upstream and Downstream Processes

Exploration

The supply chain begins with finding economic reserves (i.e. deposits that are worth more than it takes to extract them) of minerals that can be developed and extracted. There is a confluence of non-technical factors that influence the economics of a deposit, such as regulation, permitting, labor, and market price for the commodity. For some commodities, the bottleneck is permitting and developing already known reserves, however in many cases, more fundamental supply and higher grade deposits are needed for our future supply chains. Two examples in today’s landscape are downtrend in high grade discoveries of critical minerals like copper and zinc 2, and fundamental supply bottlenecks in high-grade nickel from Sulfate deposits3. There is a fundamental need for more exploration in order to re-shore/friend-shore strategic and economic reserves.

The industry has a poor performance record of finding economic reserves. Discovery is a depressingly underperforming area. In figure 4 below, every $1 that is invested into discovery yields $0.81 in returns. The industry overall is largely losing money in this part of the process, making extraction a difficult commercially sustainable business.

Figure 4. Returns on Exploration Expenditure

Why is this? In our private research, the incumbents (both junior and senior mining companies) are unable to leverage the myriad of sensing and sampling data now available. A massive wave of datasets from government geological surveys — such as the U.S., Australia, Japan, and Canada — containing historic surveying and drill data, along with public and private hyperspectral, gravimetric, and magnetic datasets have unlocked a golden age of exploration. Leveraging this data for improved area targeting is a huge lever for the industry, especially since it can reduce exploration costs attributed to diamond core drilling (which hovers around 41%)4 . We’ve seen several interesting companies in the space and believe there is room for many winners given the size of the problem and greenfield and brownfield exploration to be done.

Minerals Extraction

After deposit discovery, feasibility assessments, mine permitting, and construction completes, the extraction of the raw mineral occurs. The mining sector has focused on economic extraction for hundreds of years, but there’s massive opportunity to build better picks and shovels for the coming decades. One of the most compelling areas of extraction technology is the use of chemical engineering to target the superior recovery of metals from both run-of-mine and low-grade tailings, such as what Jetti Resources is doing in the copper industry. This sort of technology is especially important because ore grade quality is decreasing in many major mines.

Other companies look to design exotic nanomaterials, membranes, or even plants — such as Genomines — in order to radically change the extraction dynamics of traditionally sub-economic deposits either due to the physics of extraction or permitting requirements. The mining sector also has a lot of space for improving the operation of existing mines, ranging from intelligent operating systems for mining CAPEX, to emerging research in the area of optimal drilling and extraction.

Critical Minerals Processing

Most of the critical minerals processing happens outside of the U.S. In fact, most of the nickel, cobalt, and lithium processing happens in China. This leaves the U.S. government and industry at a severe disadvantage when it comes to a secure, affordable, and performant manufacturing base.

Figure 5. Critical Minerals Processing

For use in end products, minerals extracted from the earth need processing into specialty chemical products —such as lithium hydroxides and carbonates — or metal concentrates. Companies using advanced process control and chemical engineering to radically shift the economics and quality of processing — while making a domestically permittable solution — will be unbelievably valuable. Additionally, unlocking flexibility where a new processes can be deployed, like what Mangrove Lithium is doing in the Lithium Hydroxide space, is a key component to industry success.

Closing

The future of our economy and national security has always been dependent on resilient supply chains for energy independence and advanced manufacturing. This critical part of our economy shapes so much of our daily lives, and as such, we need to ensure world-class talent is focused on the problem and supported by capital partners with deep operating experience. There are huge opportunities across the critical mineral supply chain for ambitious founders and teams. At Eclipse, we’ve invested and built full-stack companies driving the Industrial Evolution across supply chains, advanced manufacturing, and more, for the last decade and believe the time is now to rebuild our physical industries and ultimately, the New Economy. Come build with us.

Thinking of a company or wanting to start one that tackles any of these challenges? Eclipse partners deeply with entrepreneurs starting at the pre-idea stage through our Venture Equity Platform. Please reach out to ryan@eclipse.vc to explore building together.

Follow Eclipse on LinkedIn for the latest on the Industrial Evolution.

Related Articles

The Industrial Evolution: Paving the Way for a New Wave of Good Jobs

Read More

Electrifying the Marine Industry: Mitch Lee, Co-Founder and CEO, Arc

Read More

Defining Modern Space Security: Even Rogers, Co-Founder and CEO, True Anomaly

Read More